This house on Wisconsin Ave. NW was demolished by greedy high-rise developers — no, wait, it was merely moved around the corner to face Macomb St. The high-rise is actual infill, in that it fills in what had been a square of grass. Keeping the house (which might have been part of a bargain with the neighborhood) can help to recoup most of the land acquisition cost.

Infill, rather than demolition, was pretty typical of how “missing middle housing” was originally built in its early 20th-century, pre-zoning heyday. It’s also how middle housing development generally pencils in the present day: “the best way to make an infill project work is to avoid demolition.”

Even though houses in locations like Upper NW DC are expensive, houses’ yard space is some of the lowest-valued land in cities. Moving a house on its lot is a way to buy just the yard while leaving the use value of the house intact. (I had hoped to take a similar approach with my Redgrove project by building just within the backyard, but alas couldn’t get zoning permission to retain the house. Instead, the site has to be 100% townhouses, and the original house will be demolished soon.)

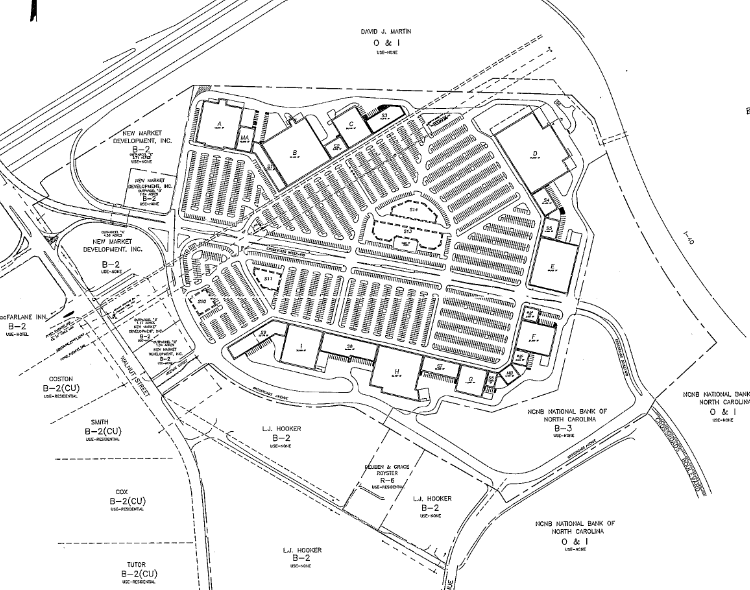

A century-old example is the Coolidge Corner section of Brookline, Massachusetts, where my grandparents once bought a triple-decker and where John F. Kennedy grew up. The NPS website for the JFK house includes this Sanborn insurance map slider, which shows how Coolidge Corner’s building stock changed between 1907 and 1919 — including both the Kennedy’s house and my grandfather’s triple-decker.

The maps shows that flats (shown on the fire insurance maps in red, as they were built out of fireproof brick) were usually built on vacant, but already subdivided, house lots. Sometimes, a wooden house (shown in yellow) would be moved on its lot to make room for flats–e.g., the two circled houses at the corner of Harvard and Green Streets were rotated away from Harvard St. to make room for shops on the same lot. A ~1919 photo shows Jack and Joe Kennedy Jr. standing amidst a half-built suburban subdivision. Few houses were demolished entirely to build just flats — though some were for larger buildings, like the mixed-use complex in the obtuse corner.

People like Rose Kennedy, who moved into a new-ish wooden house in Coolidge Corner in 1914, did not approve. In 1973, just after my family arrived, she called the area “built up now… congested and drab” (pg. 33). Keep in mind that Joseph Kennedy Sr. moved there as a bank president. Single lots and detached houses in Coolidge Corner in the 1910s were already a luxury, perhaps because restrictive covenants required a minimum house value.

Despite those covenants, this pre-zoning suburb was demographically mixed—because nuclear-family SFH-owners like the Kennedys were the exception, while extended families & renters were the norm. The 1920 Census found the Kennedys’ block was 68% renters and had 47 unrelated boarders! Roomers and live-in servants were surprisingly common in many urban and suburban neighborhoods into the early 20th century, until early zoning advocates forced them out. In that sense, my grandfather bringing his multigenerational family (and renters) to the area wasn’t anything new, even in a rich suburb like Brookline. Also, every neighborhood has always been changing forever and always will, the end.