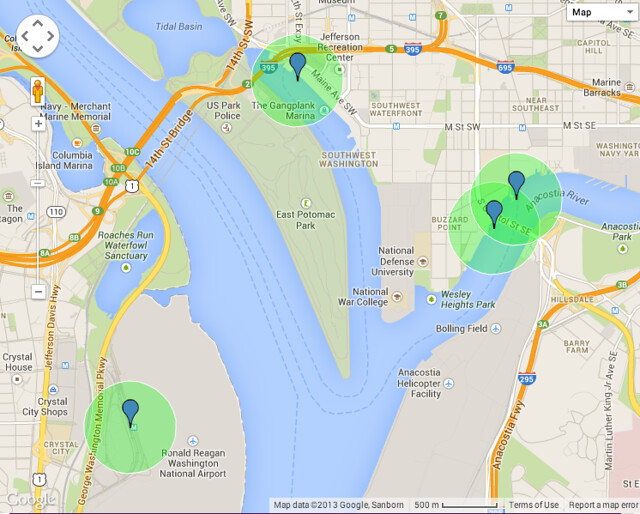

This semester, I’m taking a Natural Resources class through Virginia Tech about understanding local watersheds, wherein I’ll be researching and posting knowledge about the Washington Channel. You can explore the other watersheds that my classmates are investigating over at the class blog’s page.

In this installment, I’ll take a closer look at the woody plants found along the channel. Other posts can be found using the tag watershed.

By and large, the plant life along Washington Channel is a tale of two monocultures. Its filled-in banks long ago had their native species removed; instead, people have planted two species in abundance: ornamental cherries in East Potomac Park on its west bank, and willow oaks on the circa-1970 Waterfront Park on the east bank. The effect of having so many identical trees might be unnatural but can be enchanting, certainly in the early spring when the world-famous cherries bloom:

And also in the autumn when the willow oaks turn gold:

The large shade trees planted here often were chosen to tolerate the damp, mucky landfill soil; some were chosen for ornamental fall color, as well.

- Willow oak [Quercus phellos], as mentioned above, was planted along walkways and streets throughout Southwest Waterfront. Some have grown to ~80′ tall.

- Scarlet oak [Quercus coccinea] is also found along streets.

- Sugar maple [Acer saccharum] was planted along streets and in landscapes, perhaps for fall color.

- River birch [Betula nigra] grows in a few clusters in East Potomac Park [photo].

- Baldcypress [Taxodium distichum], a deciduous conifer common in bayous, has recently been planted near the golf course [photo].

- Black willow [Salix nigra] is one of the taller trees along the channel [photo].

- Swamp cottonwood [Populus heterophylla] also thrives along the west bank [photo].

- Honeylocust [Gleditsia triacanthos] is a common urban street tree, since it permits dappled sunlight below.

- American sycamore is another sturdy tree common to streets and parks.

- Zelkova [Zelkova serrata] is another common street tree.

- Eastern white pine [Pinus strobus] appears to be one of a few evergreens planted in East Potomac Park [photo].

As an intentional urban landscape lined with grassy or paved open spaces, smaller ornamental trees are more plentiful along the Channel.

- Flowering cherry trees of several species, principally yoshino [Prunus xyedoensis] (including the “original shipment” within the golf course; the Historic American Landscape Survey record has extensive evidence) but also the double-flowering Kwanzan [P. serrulata] and weeping Higan [P. subhirtella], plus small numbers of a few other cultivars and species.

- Hawthorn [Crataegus species], crabapple [Malus fusca], and callery pear [Pyrus calleryana] have been planted to complement and extend the cherry-blossom season, and similarly produce inedible fruit.

- Weeping willows [Salix babylonica] droop over the west bank of the Channel.

- Crapemyrtle [Lagerstroemia indica] is a very common small flowering tree in residential landscapes.

- Kousa dogwood [Cornus kousa] is another popular small flowering tree.

- Some small magnolia trees, probably saucer magnolia [Magnolia stellata], near residences.

- Chinese holly [Ilex cornuta] trees shelter the Maine Lobsterman from cold north winds.

Several urban weeds are also common along the Channel, notably white mulberry [Morus alba] and tree of heaven [Ailanthus altissima] [photo].

Plans for redevelopment of the Channel’s east bank, roughly between 6th and 12th St., call for a greater variety of mostly North American shade trees to replace the willow oaks. These include Kentucky coffeetree [Gymnocladus dioicus], honeylocust, tulip tree [Liriodendron tulipifera], blackgum [Nyssa sylvatica], swamp white oak [Quercus bicolor], and Chinese elm [Ulmus parvifolia].